The Royal Commission is finally done.

What does that mean for the value of a Finance Broking Business? For those of you connected to the industry, how can you best plan for the future?

Valuation

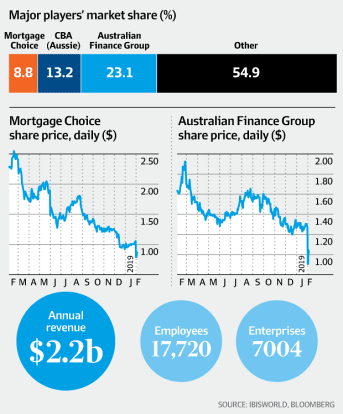

We can take some guidance from the 50% of mortgage broker market share held via ASX listed entities.

In the graph below, they have all experienced steady decline, with last Monday's report slicing another 25% of an already discounted valuation.

For small and micro businesses (the remaining 7,000 enterprises) it will need a little more time to play out. Though, much like during the GFC there will be a reaction when owners work through what it means for them.

If you are selling a client base or loan book however, you can expect a discounted market price in comparison to 2018.

In the longer term, an exit strategy based on a sale as a multiple of Profit, is preferable to just a multiple of trailing commission (if indeed this is material in the future).

For those committed to remaining in the industry, the opportunity is to make your business model robust and profitable, especially whilst the current remuneration structure remains in place.

Trends

i) Greater Technology & Efficiency

Hayne draws reference to the fact that mortgages are not complicated. In the purest sense this is true, and wisely he is not promoting more regulation or complexity.

If we think that point through, the mortgage industry has been in a total panic. Now that the RC is done, the focus will shift back to the reality of commerce again.

Ultimately, there will be automated verification and fulfilment, with the focus of the broker time on the actual advice. Less time, less remuneration.

ii) Greater Advice Consolidation

Hayne calls for a higher duty for brokers. What he is effectively calling for is more coordinated expertise around the broader issue of cash flow management, money decisions, planning and budgeting.

Says Hayne:

“Mortgage Brokers are essentially providers of financial advice”; and

“After a sufficient period of transition, mortgage brokers should be subject to and regulated by the law that applies to entities providing financial product advice to retail clients.”

I am surprised the implication of this hasn't been subject to more comment.

This could impact the qualifications, roles and expectations of both financial planners and brokers providing advice to retail customers. They will have to become more aligned and consolidated.

This is potentially significant and mortgage brokers need to be aware of the crossover in advice.

iii) Industry Consolidation

On first implication, there will be less money, higher standards, and a wider scope of work. That of course can’t happen without structural change.

Whilst there will be greater deal efficiency, brokers will be required to operate under an increasingly professional environment and be held to higher standards.

As we have seen in the UK below it is inevitable that broker groups will look to consolidate. Firms will look for a better recovery of fixed overheads, and access to wider expertise.

iv) Lenders

Australia is a highly regulated market as we know. Everyone is assuming that the major banks will get massive benefit from the proposed changes; I am not so sure that this is a given.

In mortgages, future success for the majors will be contingent on the ease of doing business. In the U.K. their majors developed processes that built collaboration with brokers and they retained strong market share.

In the U.S. they didn’t, and instead they lost retail market share. Their role changed to wholesale funders to other mortgage platforms.

In commercial finance, much like overseas, the market will disperse and the majors will lose market share. As the second tiers cannot or will not fill the gap, more niche debt funders will grow in Australia. When this occurs, they can be rated for bond issuance or other funding mediums, and pricing will become increasingly competitive.

This will be a great opportunity for finance brokers in Australia.

Looking Overseas

It is worth looking at experiences overseas, just to get a sense of how to prepare and adapt for change.

In New Zealand brokers have around 35% market share so way less than the 60% we enjoy in Australia.

Banks removed trail commissions on home loans in 2006, commissions going from around 65 points upfront and 20 trailing, to circa 85 points upfront only.

Recently, half of the banks have gone back to trail of around 15 and a reduced upfront of 50-60 points. (Remember – it was banks that wanted trails in the first place to better fund this variable cost base).

There are similar discussions there about the value of broking. For example, BNZ is taking brokers head on with an aggressive marketing campaign promoting their proprietary channel. They never liked brokers (think NAB in the old days here and are acting like CBA are now).

Some of the compliance issues raised in Australia are coming to NZ too, because of the process big brother has been through. Consumer groups are circling.

In the U.S. it is seriously complicated as the structure of their funding is unique. Non-banks originate more loans than banks. Prior to the GFC, many brokers and funders were gouging customers without full transparency in many cases.

The post GFC regulation was harsh and brokers got caught in the fire. Their market share falling from their 70% peak to almost being wiped out. Arrears rates and net equity positions have improved and returned to more normal levels and brokers are slowly rebuilding again.

Their upfront fee (1%+) can be funded in a variety of ways (either client or bank but not both).

The share of loans by the largest three big banks has dropped from 50% to 20% percent, which is relevant to where we are going as an industry in Australia with the advent of technology.

The so-called Netherlands model is where "fee-for-service" means fee-for-service; beyond the initial meeting, legislation insists that brokers must charge for all subsequent work/reviews. For example, if you call a broker to confirm initial borrowing capacity, you will get an invoice for that even if you do not proceed any further.

It is therefore a struggle for some to access advice, so potentially unintended consequences and it may mean that this advice is not easily accessible.

The U.K. went through structural changes after the GFC, and in my view gives us the best confirmation of the way forward.

There are fewer Mortgage Brokers in the U.K (10,000) than Australia presently. Their industry has fallen by almost two-thirds since changes to process were made via the Mortgage Market Review (MMR) which took effect in 2014, imposing very high quality and operating standards.

However, those still in the industry have grown market share from 50% to 70% as they have reshaped and re-energised their business models. Fulfilment is very tech driven and efficient.

Remuneration is based on a combination of fee and commission (generally 40 points upfront) which is regenerated every two years through their preference (via aggressive pricing) for 2-year fixed loans. Interestingly, some banks are looking at “retention allowances” every two years to prevent the renewing or refinancing of existing loans so a quasi-trailing commission. Halifax (one of the majors) has just confirmed it will be paying the same upfront to brokers for retention or refinancing.

Their major 6 banks (unlike the US) control a much greater share of the total market as they have embraced the broker market in a coordinated way.

On this point too, customers have clearer expectations of how the broker works with them. The broker typically assists with other financial service and insurance requirements to complement their income.

Summary

Get prepared for change, and not just in remuneration. Remember that customers will still have a need for the services that you provide. There is a reason your business has been successful.