Nothing is normal in 2020, granted.

I was fascinated however by CBA's recent decision to automatically reduce home loan repayments, back to their minimum required repayment. (Note: This is a separate initiative from the previously announced option to suspend mortgage repayments).

CEO Matt Comyn said the move was being made “given the current uncertainty surrounding coronavirus” and as part of the bank’s steps to “continue providing the financial support [CBA] home loan customers need”.

You will have go through a process to "opt out" if you don't want these changes to apply to your mortgage.

He also said the “one-off change” is aimed at “helping to put a little more cash in the pockets of our customers during these difficult times”. Further, it would “release up to $400 per month for customers and create up to $3.6 billion in additional cash support for the economy”.

Let's pause on that last sentence for a moment.

So, will you do it for your country?

The context of CBA's commentary is in one sense leadership. As the nation's biggest mortgage provider its actions make a material impact.

Reducing the monthly repayment commitment on your mortgage is definitely good for the economy, as that surplus cash flow will find its way to additional spending. So, like Peter Costello's baby incentive mantra in the mid 2000's "one for the country", we are encouraged to effectively do so again.

Though is it good for you and your Household?

Taking the Longer Road

Australia appears to have an obsession with avoiding a recession and any short term economic pain. This may be a good sentiment, however we are effectively encouraging behaviour that might be bad for households' long term financial position.

In other words, an increase in immediate discretionary spending which is the "hit of sugar" to the economy. This is opposed to the opportunity cost of either additional saving, keeping existing mortgage payments or additional investing.

I find it ironic.

The Economics

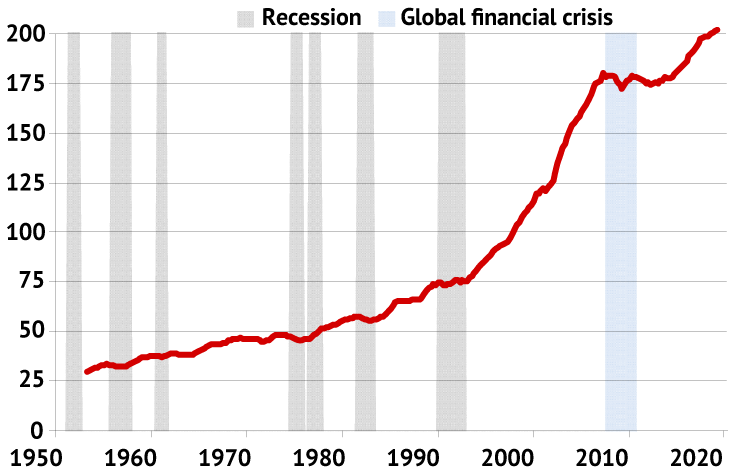

Staying with macro economics, by most measures households have too more gearing. The economists around the world have been telling us that for years. Take a look at a graph from the ABS/RBA below showing the debt to income ratio of households which is at a peak.

This debt to income imbalance is despite low interest rates, as households struggle with rising costs at a time of low wage growth.

Compounding this too, is the high asset prices which come partly from the low borrowing costs. To put this in more context, the average size of a mortgage in Australia has increased roughly in line with property prices over the past 20 years. Income growth has not matched this however.

To be fair, the news on household finances is not all bad. CBA's CEO added that “Our home loan customers are on average 37 months ahead on their home loan repayments".

That is positive, though not sure that increased non-essential spending fixes the long term structural issues in our householders' balance sheets.

The Opportunity & The Opportunity Cost

To "do it for the country" means accepting your reduce repayments and make sure that the resultant difference is spent in our local economy.

To take a longer term view, this means taking a look at your own financial position.

This may be an opportunity to forego discretionary cash flow (if you can) and maintain additional mortgage repayments. Alternatively, if the opportunity cost is better, invest it.

Either option is likely to be a better outcome for your household in the long term.

For more information:

P - (03) 9620 2001

E - enquiry@mcpgroup.com.au

W - www.mcpfinancial.com.au